The One Stop Platform For Trade Creditors.

Digital on-boarding, FICA compliant application vetting, credit bureau access, pre-legal and book management.

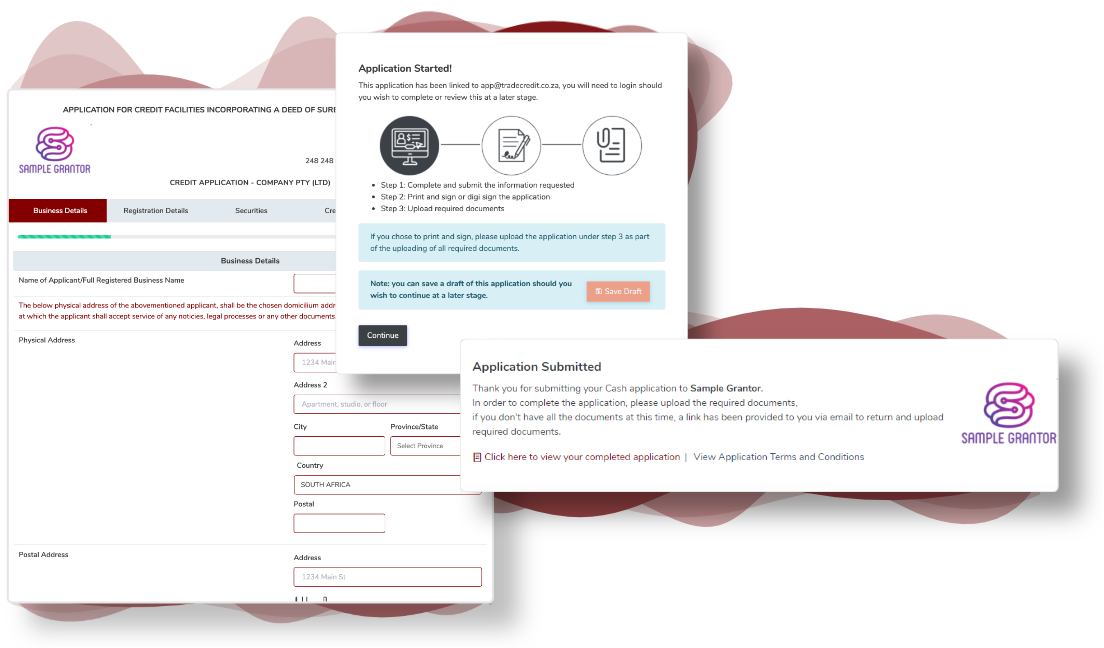

Fully Digitise Your Customer On-boarding

With an easy to use digital application process, your customers can complete an online, secure on-boarding. Includes digital signature and document centre for accompanying documents. Applications can be customised to suit your needs.

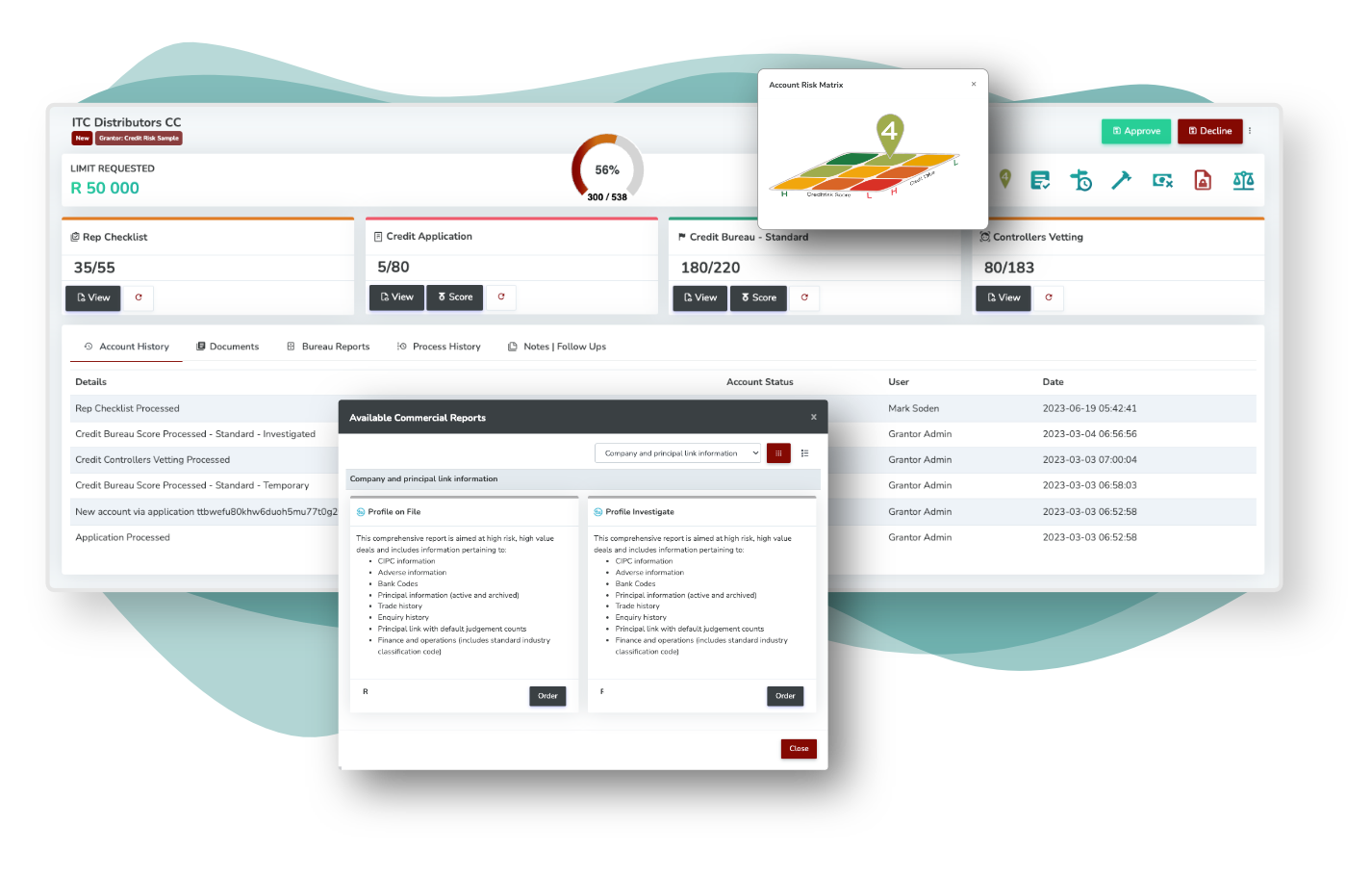

Guided Vetting, Risk Scoring & Bureau Reports

Giving your business a vital competitive edge through our thorough and transparent, FICA compliant, vetting process which takes less than 15 minutes.

Direct access to leading credit bureaus provides access to reputable data to better manage your risk.

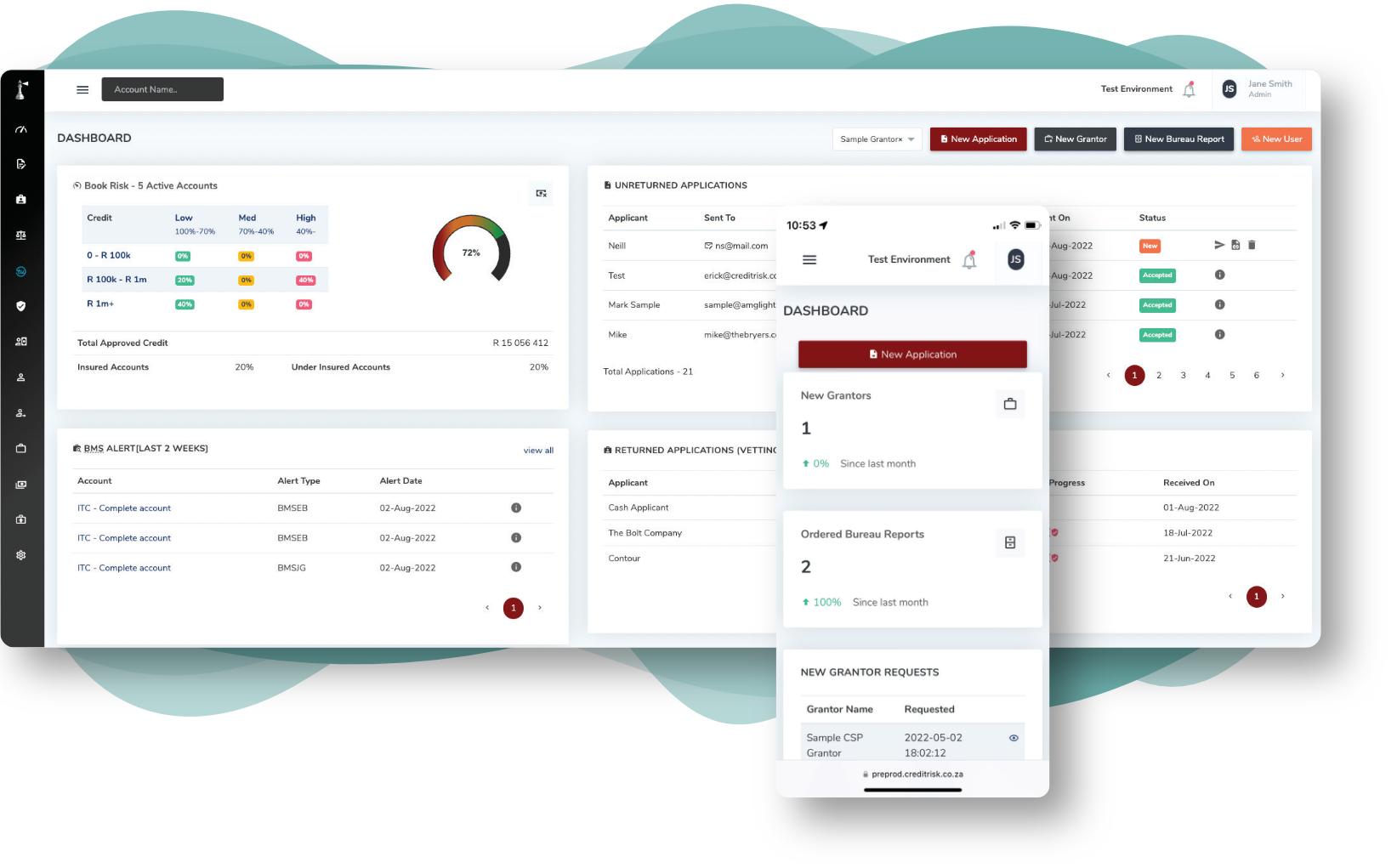

Book Management

Gain valuable insights into your Age Analysis. Simplify your daily tasks and effectively manage age analysis data with our Prioritising and Segmenting functionality. Stay organised and on top of follow-ups with our user-friendly Diary feature, ensuring efficient tracking and management. Elevate your credit control process with our comprehensive suite of tools designed to optimise efficiency and maximize results.

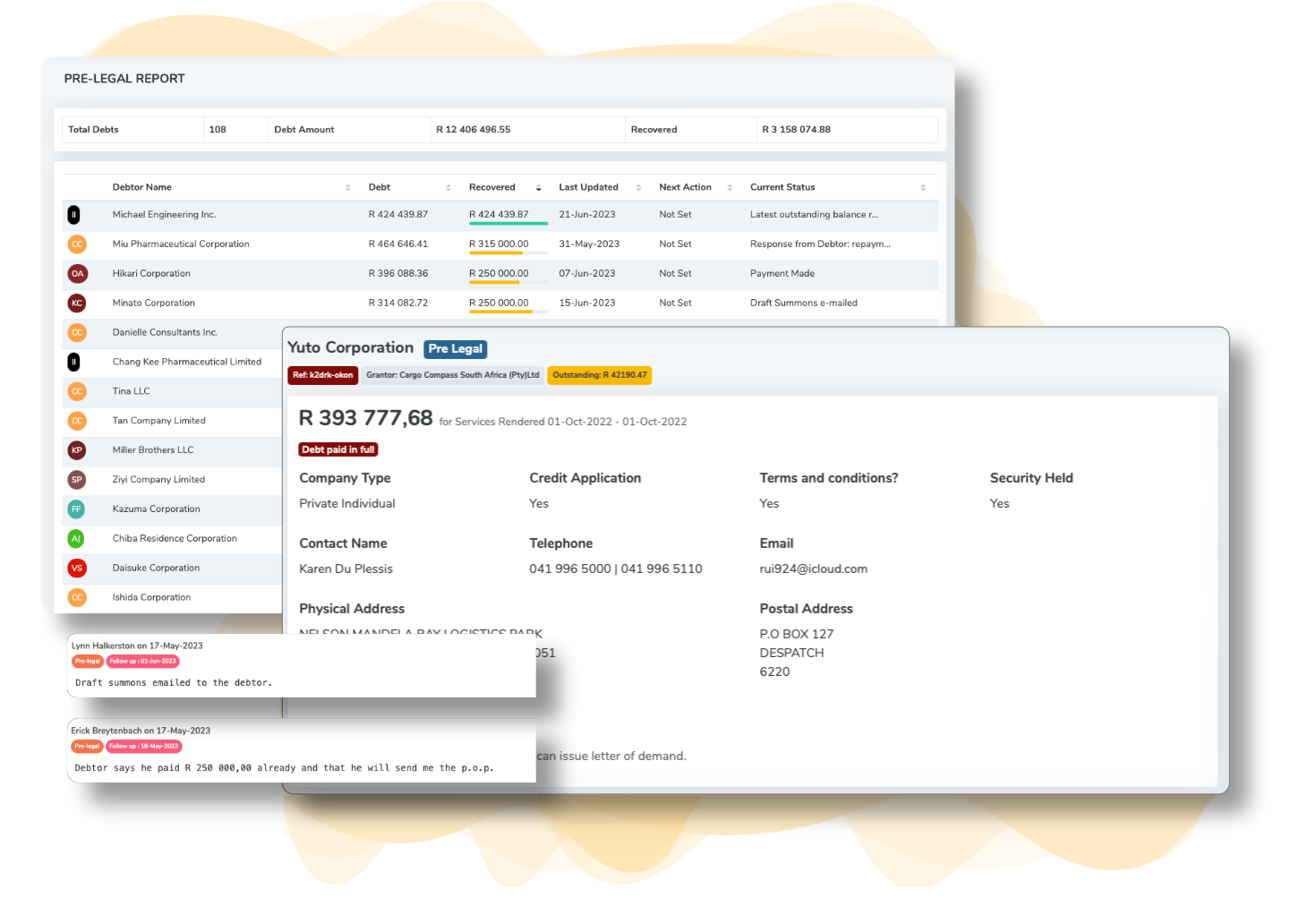

Pre-legal collections

Professional assistance and support with Pre-Legal collections by Erick Breytenbach Attorneys, specialists in Commercial Debt and Recoveries. Instant access to status reports, notifications and uploading of documents. An interactive platform enabling instant and real-time communication between the collectors and the client.

Request Demo

Head Office

083 628 2391support@creditrisk.co.za

Ridgeview Office Park

248 Kent Ave, Ferndale, Randburg, 2194

Available Plans

|

Express R 400 per month Start |

Comprehensive R 1 250 per month Start |

Enterprise R 2 500 per month Start |

|

|---|---|---|---|

| Per additional division/branch | ∞ | ∞ R 1 000 | ∞ R 1 000 |

| User Limit | ∞ Unlimited | ∞ Unlimited | ∞ Unlimited |

| Account Limit | 250 | ∞ Unlimited | |

| Bureau Reports | Pay per usage | Pay per usage | Pay per usage |

AFS Analysis AFS Analysis |

R 30 per analysis | R 30 per analysis | |

| Default Listings | Pay per usage | Pay per usage | Pay per usage |

| Pre-legal Collections | 10% - over R15k 15% - under R15k |

10% - over R15k 15% - under R15k |

10% - over R15k 15% - under R15k |

| Registered letter of demand | R350 per letter | R350 per letter | R350 per letter |

| Responses to clients letters of demand | R850 per month | R850 per month | R850 per month |

| User Role Management | |||

| Digital Application | |||

| Sales Rep Checklist | |||

| Application Vetting | |||

| Book Management | |||

| API Access | |||

| Custom Application Access | |||

| Custom Application Build | Quote based on scope | ||

| Customer Support | Online support and documentation | Online support and documentation | Online support and documentation |

| Customisation | Quote based on scope | Quote based on scope | Quote based on scope |

| Custom Integrations | Quote based on scope | Quote based on scope | Quote based on scope |

| Batch Bureau Reports | Quote based on volume | Quote based on volume | Quote based on volume |

Our Partners

Our partners are reputable providers in the credit bureau, credit management and debt collection industries.

Hundreds of businesses are already using Creditrisk to simplify onboarding and take control of their book risk.

Trade Creditor's Handbook - New Release!

Order Now

This easy-to-read handbook is aimed at students of trade credit, business leaders, entrepreneurs, financial directors, credit managers, credit controllers, sales representatives and anyone who has a keen interest in starting a business. With over 30 years of experience as a specialist attorney, who is still acting on behalf of numerous trade creditors, credit insurers and credit bureaus, the author has seen the many pitfalls of running a business. The lifeblood of any business is its cash flow, which is almost wholly dependent on the effective management of its single biggest asset, its book debts and overdue accounts. From practical examples and latest trends, the reader will be taken on an interesting journey through the entire credit management cycle, from the vetting and onboarding of potential customers, to accounts management and the latest collection strategies. Apart from providing many useful strategic business insights, this handbook will hopefully also act as a spark to help restore business confidence in South Africa.

Order Now